3 Reasons You’re Still Not A Profitable Trader & The Solutions

It is an undeniable fact that the vast majority of traders reading this are not consistently profitable. Some last a few months in the market, while others last a few years or more before finally throwing in the towel. In fact, just last week I had a trader email me saying that she had been trading forex unsuccessfully for over 8 years before joining our service! While I admire that type of determination, the fact is it shouldn’t take that long to become a successful trader! If you have been learning to trade for months or years, if you have tried all the trading strategies, indicators, and EA’s then this article is for you. Over the past 7 years of running DTFL, I have had the opportunity to interact with over 10,000 forex traders in some way, shape, or form. Having had so much interaction with retail traders gives me quite a unique position to see the most common points of failure. Over those years, and having dealt with so many aspiring traders, I have seen 3 traits that are a plague, literal gangrene that eats away at the possibility of becoming a full-time trader.

Cognitive Dissonance Among Traders

First, we have to understand what cognitive dissonance is to understand how it relates to trading. Wikipedia defined cognitive dissonance as, “the mental stress or discomfort experienced by an individual who holds two or more contradictory beliefs, ideas, or values at the same time, performs an action that is contradictory to one or more beliefs, ideas, or values, or is confronted by new information that conflicts with existing beliefs, ideas, or values.“

What is a good example of cognitive dissonance you might ask? Think about someone you know who smokes. In their mind, they know for sure that continuing to  smoke cigarettes can shorten their lifespan, but on the other hand, they love to smoke. There is a constant rationalization in their mind which allows them to continue the action that conflicts with the information they know to be true about the effects of smoking on their health.

smoke cigarettes can shorten their lifespan, but on the other hand, they love to smoke. There is a constant rationalization in their mind which allows them to continue the action that conflicts with the information they know to be true about the effects of smoking on their health.

How does the theory of cognitive dissonance affect retail traders? As it relates to trading, we are going to focus on the part of the definition that I have underlined above. This part points to an individual being “confronted by new information that conflicts with existing beliefs, ideas, of values.” To some extent or another, what do the vast majority of forex traders believe or hold to as core ideas? After dealing with close to 10,000 traders, what I say next is not opinion, but rather a very common observation. The vast majority have spent months or years searching for the magic indicator, the simple system that “even your grama can learn in 1 hour or less”, or the EA that “makes money while you sleep guaranteed.” After getting burned enough times people eventually come to realize there is no 1-minute fix to becoming a profitable trader. Even still the vast majority will continue to buy the same get rich quick junk over and over. This is a great example of a belief being opposite to the action.

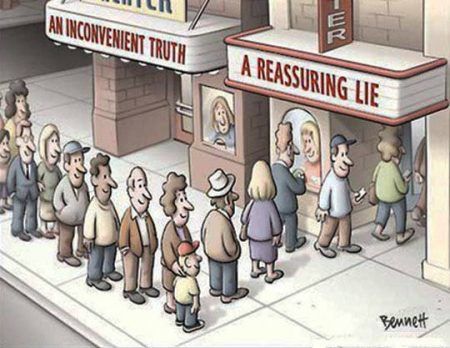

Why would someone continuing doing something that they know on some level won’t work? If someone in that situation stops the hunt to make an easy buck, then they have to come to the realization that they had been wasting both their time and money. There is a lot of “hope” and “dreaming” that comes with searching for the holy grail. Giving up the idea of overnight Ferrari’s and private jets isn’t something people tend to do without a struggle.

Solution: The key point of this topic is quit system jumping in search of a holy grail or magic bullet! You must come to the realization that trading success can only be found in the same manner you find gold….at the end of a shovel and ton of hard work. Find something that you believe in and trust, and then stick to it. Maybe you take bits and pieces of different strategies to make your own, or maybe you follow a mentor’s strategy 100%. Regardless of what you do, if you invest less than 3 months learning something creditable before quitting on it, then you are doing yourself a disservice.

What Fat People And Forex Traders Have In Common

I already told you I was going to offend some people, so if you’re still reading and you’re offended, then you have no one else to blame but yourself. I had an epiphany a few days ago, and it started when I noticed a commercial for “P90X”. Have you heard of it? I’ve read it is the greatest selling weight loss/workout program in history, having sold over 4.5 million copies through 2013. There is literally NO DOUBT, which if someone follows through on the entire program they will certainly be in much better shape by the end of the 90 days. Hell, even if they did 50% of the recommended work and diet, they would see tremendous results! Let me ask you this though, how many people actually follow through with the entire program? In researching the answer to that question, I found out that at BEST only 10% of people will follow through with a workout or weight loss plan. Sound familiar to the forex market? Here comes the unpleasant truth many will not want to hear.

You see, like those who are looking to lose weight, most forex traders want the results but don’t want to put in the effort. If you sit around all day and eat donuts, you’ll get fat, and if you go after the same hype driven get rich quick schemes, you will keep losing money. There is no magic bullet; there is no easy fix to trading! That is worth repeating! There is no easy solution or magic bullet to becoming a profitable forex trader. It took me close to 4 years before I was profitable! I’m not saying it’s going to take you that long to be profitable, but I can speak from experience having been actively trading for close to 13 years. In my 13+ years of experience, I have never met a profitable trader that was consistently successful before 6 months of hard work with most taking longer. I’m certain that statements like this turn many people away from DTFL and to be honest that is just a side benefit to me saying that. The fact is if someone isn’t willing to commit then they aren’t going to make a very good student and therefore probably shouldn’t become a member.

Solution: We all know its human nature to want the easy solution to life’s problems. You wouldn’t have things called “get rich quick schemes” if the desire to get rich quick didn’t exist. In fact, the reason I think it took me so long to be profitable is that I spent two years trying to find the easy fix to trading. Its human nature, but in trading, it’s also the thing that will bury you! A few months back I wrote an article about 3 keys to becoming a profitable trader. In that article, I list 3 specific points that can really help any struggling trader get on the right track and I would encourage you to read that after finishing this post. All the points I list in that article share one core belief which is that trading is a long-term process, and success only comes after months or years of hard work and dedication. The bottom line is if you’re not committing days rather than months to learn a strategy, you should wonder why “none of them are working.”

The Dreaded Drawdown!

Have you ever had a drawdown? If you have been trading for more than a few weeks, then the answer to that question is a resounding yes! This is one major reason that trading is such a difficult game to master or become successful at. Why? What happens to you when you are in the middle of a series of losses? Emotion begins to take over, and mistakes begin to happen. Below is a list of 3 very common mistakes new traders begin to make as they start to experience multiple losing trades in a row. This list could be much longer but here are 3 of the most common and often most detrimental.

1.) You start to question your entire strategy, even if you have seen it work for months or years.

2.) The urge to use higher leverage to ‘make back’ your losses even faster becomes incredibly strong.

3.) Looking for random setups that have nothing to do with the strategy you are trading is commonplace.

The trouble with these 3 points is that it only compounds the original problem, as it will often lead to more losses of even greater size due to the increase in leverage. This downward spiral will many times result in the trader blowing up his or her trading account. “Obviously” once the account is blown up they “have to” look for a new strategy as the blame couldn’t possibly be their fault (sarcasm included). Dealing with drawdowns is tough, but they are often NOT the main reason someone blows up their account. If you reflect back on anytime you have blown up your account it often starts with a few losses. After a couple of losses, human emotion begins to push you into 1 of if not all of the 3 common mistakes addressed above.

Solution: Understand that losses are part of the business! The greatest traders in the world have losses, and the greatest traders in the world have drawdowns. The only difference is the great traders learn to handle drawdowns. That is not my opinion; it is a fact. There is no way around this, and the only true solution is accepting it as part of the business. Many times in trading, the solution to one problem will help solve another. In the article I linked to above, I address the importance of having a long-term plan for growing your account. I would encourage everyone to write out a month by month account growth chart using a reasonable monthly growth percentage. Did you know that a $5,000 account compounded at 10% per month would be worth over $1,000,000 in less than 5 years? Having an account growth chart written out that you can refer back to will help you avoid the mental pitfalls discussed above, as it will allow you to focus on your long-term goals. Focusing on long-term goals helps to put a series of losing trades in perspective, thus giving you a better chance to weather the storm of learning to trade forex.

-Sterling

Please Leave A Comment Below

Have A Question? – Contact Us Here

Learn the bank trading strategy, join our live training room, access live member chat, as well as lifetime support? Click Here