3 Keys To Becoming A Profitable Forex Trader

This article is going to be critical to you becoming a successful forex trader. One of the biggest hurdles to becoming a successful trader is the extreme lack of patience and discipline most people exhibit. Its really quite ironic when you think about it. Because people feel like they must achieve massive success now, they unknowingly kill or at least massively hinder their chance of any success at all! This article is going to discuss how a lack of patience and discipline is sabotaging your trading habits, but more importantly I will give you actionable tips to immediately change those bad habits in the habits of consistently successful traders. I put enough emphasis on the importance of the points this article will cover. While no one can guarantee your success, I can guarantee you will not be successful without taking to heart and putting into practice what you will learn in the next few short minutes.

successful trader is the extreme lack of patience and discipline most people exhibit. Its really quite ironic when you think about it. Because people feel like they must achieve massive success now, they unknowingly kill or at least massively hinder their chance of any success at all! This article is going to discuss how a lack of patience and discipline is sabotaging your trading habits, but more importantly I will give you actionable tips to immediately change those bad habits in the habits of consistently successful traders. I put enough emphasis on the importance of the points this article will cover. While no one can guarantee your success, I can guarantee you will not be successful without taking to heart and putting into practice what you will learn in the next few short minutes.

Understanding The Problem Most Traders Face

The first step to fixing something is understanding the problem exists in the first place. After all if you don’t recognize that a problem exists then there is no motivation to change it. The problem is a lack of patience, as well as discipline. More important than the broad problem, is how this problem manifests in your trading. After all, the trades you take and how you trade is where the figurative rubber meets the road. One major manifestation of this problem, is in the amount of leverage a trader uses. How much of your account do you put at risk on any one trade? How much of your account are you willing to put at risk if you have multiple trades running? This does not have to be complicated! In fact, position sizing should be the most simple aspect of anyone’s forex trading strategy.

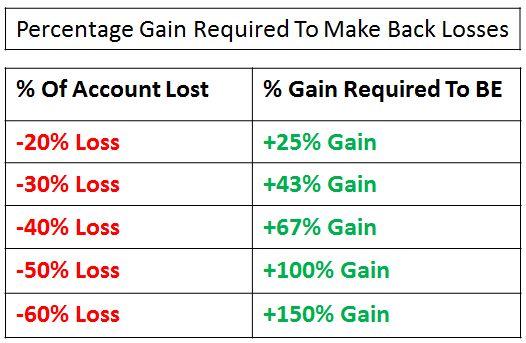

Simply put, I recommend the typical industry standard of no more than 2% risk per trade. I recommend this number with two very simple, but yet powerful changes. First, only set your 2% risk at the beginning of the month and then stick with that number. If you have grown your account you can determine 2% of your new account value at the start of the following month. The second thing I do differently is I DO NOT GO DOWN in risk from the high water mark. In other words, lets say you have a $10,000 account. 2% of $10,000 would be $200 and therefore you would risk no more than $200 per trade. Lets say that you lose $2000 during a 1 month period of trading, which would bring the account balance down to $8000. In that situation I would still risk $200 per trade instead of risking $160 which is 2% of $8,000. If you lowered your risk to 2% of the new account balance, it would require a 25% gain to recover the initial 20% loss. The gain required to erase a loss becomes more and more severe as more money is lost.

You might be thinking that not lowering the risk is dangerous. To the average retail forex trader who shouldn’t even have a live trading account you would be correct! You should not use the position management style discussed above unless you are a profitable trader with a proven trading strategy. If you’re still a struggling trader then you should be trading with a demo account or find a forex broker that allows micro lot position sizing. Once you have at least 3 months of consistent and profitable trading, then and only then would I recommend adopting my method of position sizing that adjusts only once per month based on a new high water mark in the account value.

To summarize, 90% of traders have unrealistic goals on achievable account growth. As such, they risk far too much of their total account size on any one given trade. This ALWAYS leads to eventually wiping out your account and if not changed will guarantee you never become a successful trader. What is the solution to the problem? Risk no more than 2% of your account (using the high water mark method) on any one given trade and more importantly stick to it no matter what! If you can do this one small step you will be ahead of 90% of all other retail traders who treat the forex market like a casino rather than treating it like a business.

The Power Of Compounding

This is where things get interesting! This is where you get to see the power of consistent compounded growth and you get to realize your goals and dreams are not as far away as you thought. Albert Einstein said that, “Compound interest is the eighth wonder of the world.” Einstein went on to point out the fact that compound interest can both help and hurt you. The rich are masters at making their money work and benefiting from compound interest. The poor on the other hand, are a slave to compound interest. They take on high interest car loans, huge interest cash advance loans, and more importantly they never use it to their advantage by saving! In trading the same parallel can be draw. Wealthy traders learn to take advantage of this extremely powerful tool, while poor traders never give it a second thought.

They say a picture is worth a thousand words so that is exactly how I’m going to illustrate the true power of compounding for traders. First though, lets understand where the numbers are coming from in the table below. Over the last 6 months I have done a month end trading results video. These video goes through every valid trade setup that occurred during the month using the confirmation entry on just the EUR/USD and GBP/USD (can be used on any other active pair). In the latest video for October 2015, I not only went through every trade but I also showed a picture of how we pre-select the exact manipulation points the night before in the members daily market preview video.

Because the confirmation entry is mechanical trade setup and the level from which we trade is pre-selected hours in advance, you know for certain if a trade was valid or not, and you also know the result. Over that 6 month period the results have been +20% in May, +12% in June, +31% in July, +9% in August, +6% in September, and +15.1% in October. If you add all those numbers together and then divide by the number of months which is 6, you get an average of +15.5% growth per month based off of 2% risk per trade. The chart below shows the result of a +15.5% gain per month that is compounded over 30 months. Obviously it is important to understand historical profit or loss is not indicative of future results but this does give a good point of reference to illustrate the power of compounding.

This chart should be extremely encouraging to every trader that is reading this article! With a starting balance of only $5,000 an account would grow to $375K in 30 months if +15.5% was gained each month. If I would have continued this chart out you would see that the account balance would have crossed the million dollar mark at the end of the 37th month. I think it is extremely important to point out that numbers on a chart and the real world are completely different. First of all there will be times where you have a losing month. I’m sure there are plenty of educators that will tell you they can teach you to win 90% of your trades. I however trade in the real world and that doesn’t exist. If I continue to do the month end reviews I’m sure you will see me post a negative month at some point. For the last 5 years I have had 1 month each year that was either break even or slightly negative…it happens. Additionally, as your account grows you would not continue to risk 2% of your account on each trade. You might, but I personally wouldn’t and I don’t. Even with those points in mind this chart should illustrate just how quickly an account can grow if your steady and consistent.

To summarize, stop chasing the one hit wonder. If you want to be the MC Hammer of forex then go for it. If however, you want to have a 10-20 year career then you need to start thinking long term rather than next week. The first thing you can do is either print out the chart above as an account growth guide or make your own and print it out based on numbers you deem to be realistic. Keeping your long term goal in front of your eyes on a daily basis will help you to stop over leveraging, “doubling down”, revenge trading, “getting back at the market”, ect. If your mind sees the big picture you are more likely to get past the short term emotions associated with any one specific trade result.

For those of you who look at the chart above and think something along the lines of, “that’s going to take way to long”, I have a few words for you. When I first started DTFL 6 years ago I use to care what people thought of the things I said lol. With that being said what I’m about to say is going to be blunt. If you think the above chart is too slow then you should quit trading forex. I can guarantee you that as long as you keep that attitude you will be best buddies with the other 95% of retail traders who are consistent like yourself….consistently losing money that is. If anything, the chart above shows unrealistically fast account growth! I strongly urge you take the power of compounding to heart. In doing so you would be wise to lower your risk per trade to no more than 2% as mentioned above, and take a long term business approach to becoming a full time trader. If you do that, then you will reach your trading goals faster than you think.

Finding A Profitable Strategy

A trading strategy is really the final part of the equation. Everything we have discussed up to this point has illustrated the importance and power of slow, steady, and consistent growth. Even if a trader believes this is the key to success will find themselves jumping from forex trading strategy to trading strategy faster than a middle school girl changes boyfriends. Unfortunately, literally nothing good can come from the constant shifting of trading strategies. If you are guilty of being an indecisive ‘system jumper’ then I would recommend doing the following.

key to success will find themselves jumping from forex trading strategy to trading strategy faster than a middle school girl changes boyfriends. Unfortunately, literally nothing good can come from the constant shifting of trading strategies. If you are guilty of being an indecisive ‘system jumper’ then I would recommend doing the following.

1.) Look at the reviews! If you go to google and type in the name the product and then add the word “review” you will find out what other people think. As an example, for DTFL you would type “Day Trading Forex Live reviews“. If you did you would find the reviews for Day Trading Forex Live at Forex Peace Army (FPA). If you type that in for a specific service you are looking for and they are not reviewed at FPA then the service is probably a fly by night and there is a reason no one has heard of them. If you find the FPA reviews and they are BAD, then once again use your head and listen to what people who have actually seen the service say.

2.) Find a strategy that fits you personally. One of the biggest things every trader needs to know is what type of trader they are. Are you a long term position trader or do you prefer short term day trading? Knowing this eliminates many trading strategies right away. Are you a manual trader or do you believe there is a magic fairy dust indicator that tells you when to buy or sell (HINT: fully automated Indicators and EA’s don’t work).

3.) Once you find a strategy with good reviews and one that fits you personally then stick to the trading strategy for 6 months! So many times traders try to learn to trade a strategy in a week or two before they give up. News flash, you competing vs the largest most well funded businesses in the world. They hire the best, smartest, most well trained individuals that live, eat, sleep, and breathe trading and you think a week or two of forex training is going to allow you to beat them consistently? There are plenty of forex educators that will tell you they can teach you to trade in a few days or a week just to get your money but you need to sit down and use your head for a minute. Not only should you not believe them but it should tell you about the character of the educator you are looking at learning from.

Putting It All Together

The long term pain of failure is always worse than the short term pain of effort! The time and effort spent learning to trade is well worth the end goal. If you have not achieved your trading goals I would urge you to put the points in this article to use now! I’ve been trading for close to 10 years and I have been teaching for close to 7 years of those years. Over 5,000 traders have gone through DTFL…I can promise you I know why traders fail. I know from not only a decade of trading experience but also personal contact with literally thousands of traders. If you use a safe risk per trade, focus on consistent growth, and stick with one trading strategy you will be in the best position for success.

If your still in the process of learning to trade I would highly recommend checking out our lifetime membership. We are doing an end of year sale which is the best price we have offered since 2012. You will get a proven trading strategy and more importantly daily support and guidance. You can find out more about our Online Forex Trading Course & Live Forex Trading Room here.

-Sterling