Intraday Pushes & Pullbacks – The Repeated Process

Welcome to part 2 of the Intraday Pushes & Pullbacks – Give It Some Thought FX+ Blog article. In the previous article I took you through step by step regarding the GBPUSD daily movement on an intraday level and also explained why it should have been a no trade. I then ended off the article by mentioning that I will explain the pullbacks in more depth and also how to think like Smart Money does regarding this topic. Put yourself in Smart Money’s shoes 🙂 and see the market as they see it. I am not talking about all the high tech data they have access to, I am talking about the thinking process behind what we see in the Forex market.

Pullbacks In A Trending Market

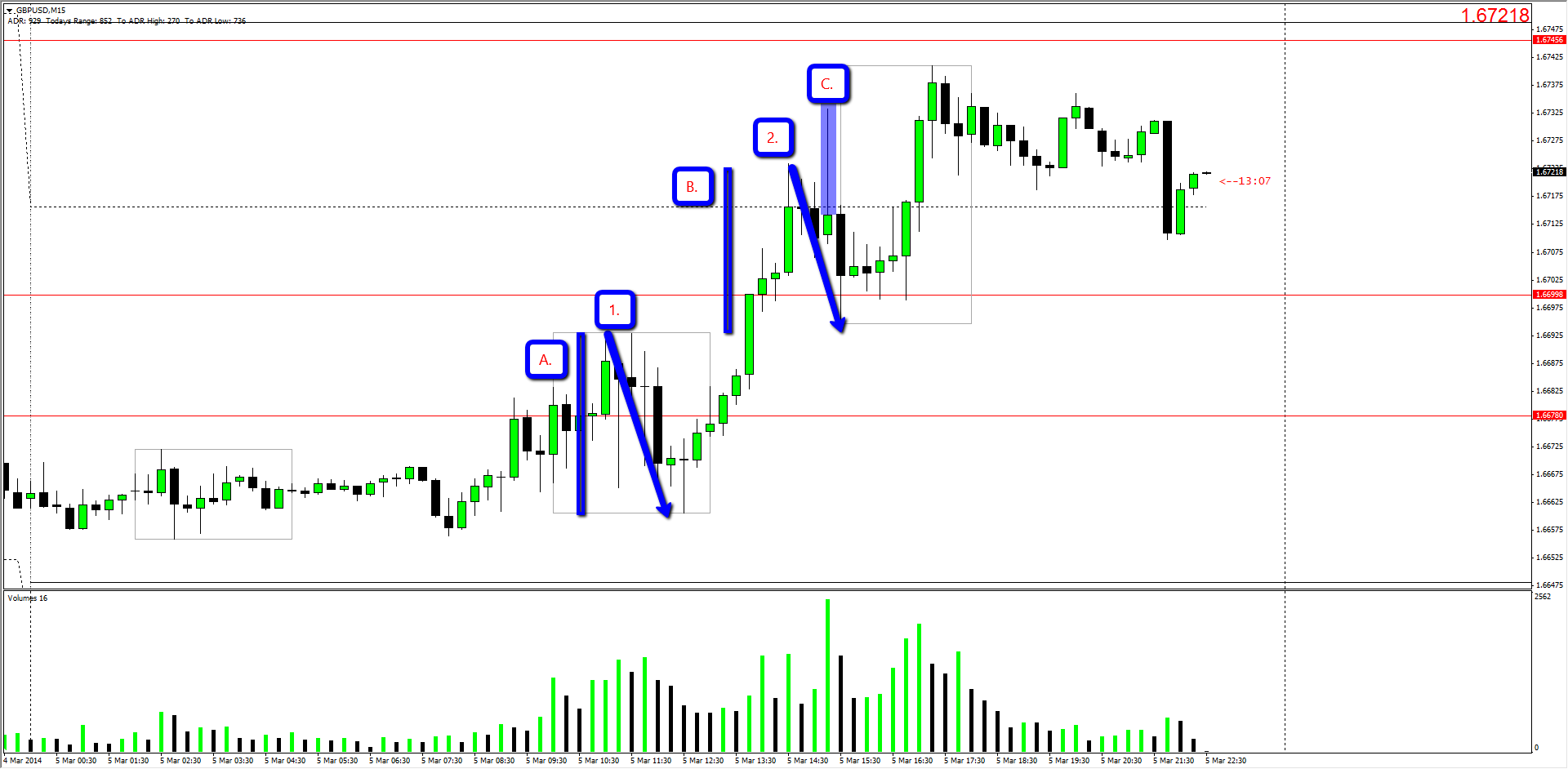

We will use the same chart as in the previous article but focus on the pullbacks that occurred while the GBPUSD was making its way to the upside.

Notes As Marked On Chart

- A. Length Of Pullback In Pips

- B. Length Of Pullback In Pips

- 1. First Pullback

- 2. Second Pullback

- C. Large Pin Bar

After breaking the Asian highs we set a new daily high. The respected high held as resistance for about 4 retests. What does the average retail trader do? They tend to pick tops as well as bottoms. So they short from that high. A. is about a 32 pip pullback. That would normally be enough for traders to move to break even or move to a positive stop loss. Price turns and stop them out on the way back up again. Secondly the traders they played the Asian break-out got stopped out on the way down as well. In both these cases SM takes out the traders before moving the market in their given direction. It is worth mentioning that a big chunk of break out traders would have been scared out of their longs if their stops were not hit during the pullback, although that would be unlikely.

This same process repeats itself once again at B. with a 30 pip pullback. The large bin par marked C. would have once again got traders long on the break of resistance before pulling back around 38 pips. Once again the same scenario that traps traders into a position before getting taken out by the market. Price thus moves to complete the third and finally push for the day. The daily range ends at roughly 85 pips which is what we expect to see as a completed cycle.

Smart Money fools you into bad trades and scares you out of good ones!

I think the above mentioned quote reflects and shows when reading this article. Money moves the market. SM will not spend $xxxxx to move the market in a given direction for no reason. Keep in mind that they need liquidity. Put yourself in their mind and think where they would best find or create it.

Happy Trading,

Allen