Intraday Pushes & Pullbacks – Give It Some Thought

After the no trade on the GBPUSD yesterday I thought it would be a perfect opportunity to discuss the “Intraday Pushes & Pullbacks” that repeat themselves over and over on a daily basis. I have had a few comments from traders saying they got stopped out of the GU short taken around the 1.6700 area yesterday, asking if it was due to the news or simply a bad trading decision. These are good questions and fits in perfectly with this FX+ Blog post! Lets first look at why the GBPUSD trade on March the 5th 2014 did not work out and should have been a no trade.

If you want to refresh your memory and recap on what was said prior to the fact you can view March 5th 2014 Daily EUR/USD, GBP/USD Analysis.

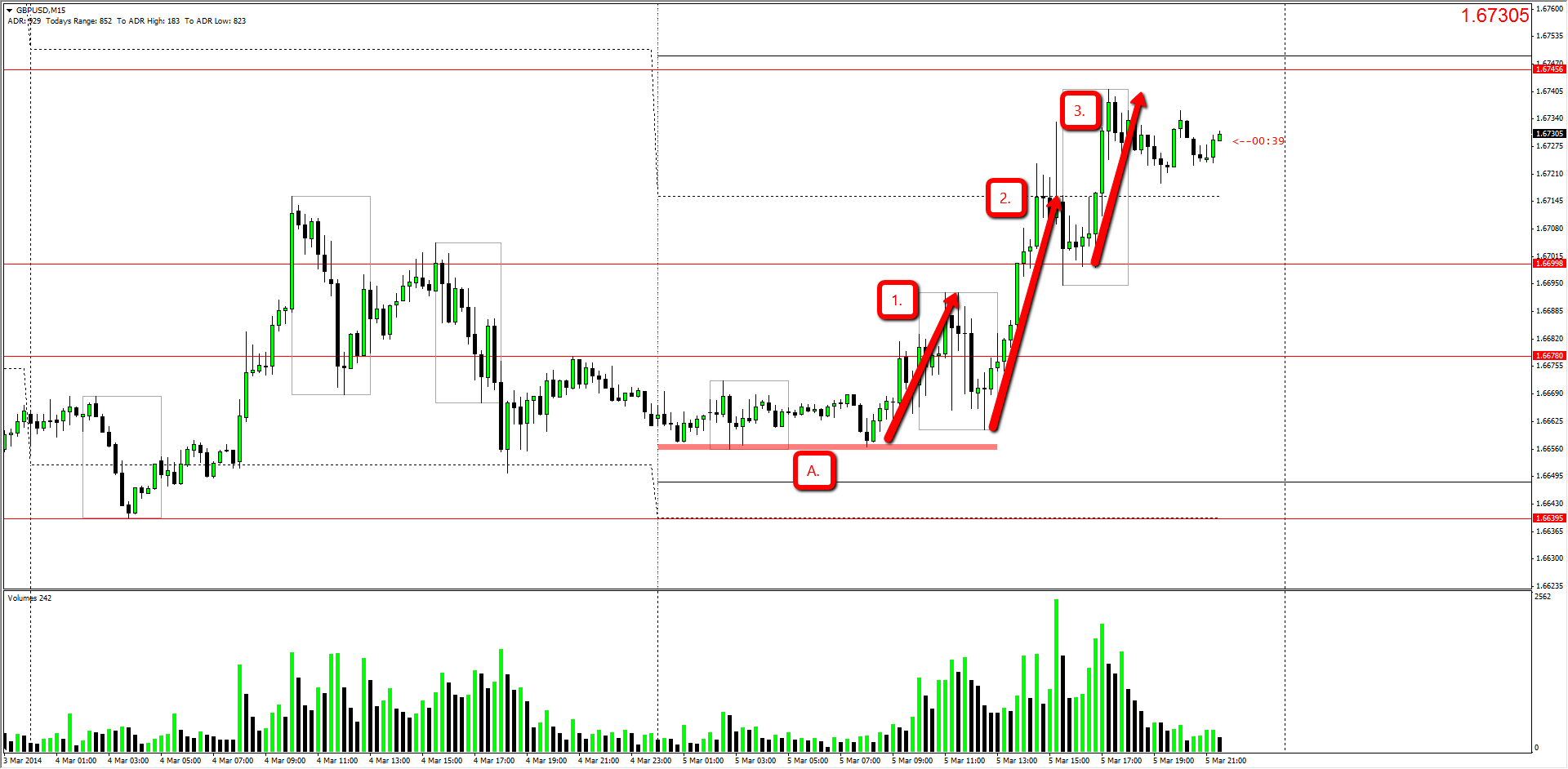

Notes As Marked On Chart

- A. Low Set During Asian Session

- 1. First Intraday Push Up

- 2. Second Intraday Push Up

- 3. Third Intraday Push Up

A Walk-Through Of The GBPUSD

The Bias for the day was in favor of the short/sell opportunity. We saw the firs push up happening prior to the London Market Open, forming of a double bottom that failed to break the Asian Lows. This small rally took us right into our first level- 1.6678, showing some rejection on low volume. Looking left this was the last point of resistance during the last part of the NY session on Tuesday the 4th. We will get to the pullbacks in the second part of this article so bare with me. As the London market opened price followed through closing above the previous mentioned level- 1.6678. A new daily high was formed and we saw price test and reject deep into the Asian range. From there we saw a steep 60 pip + rally closing spot on at the highs formed from the previous day. At this stage the second push has been completed as we see the market pause before the NY market opens. After the very convincing pin bar closing below the previous day’s high traders went into selling mode.

As mentioned in the article posted at that very moment in time I sated we should be considering that the third push is yet to come. (New York Market March 5th 2014 – GBPUSD Potential) A lot of traders got trapped short around the 1.6700 level and got stopped out soon after as the GBPUSD completed the third intraday push up. This proved to be a swift move with the help of some news. The last stop of the day was in sight which was the 1.67456 – 1.67500 with the confluence of the ADR. We sadly fell a few pips short of that which rapped up the trading day for most.

Why The Trade Was A No Go In A Nutshell

- 3 Intraday Pushes Were Not Completed

- News Around That Time

- No Confirming Candle Down

- Stop Run To The Backside Of The 1.66998 Level

Summing this up we could clearly see how traders got trapped into the short before SM completed their cycle.

There could be the argument that the second push count as the third as well. I suppose everyone will see it in a different way. This just once again shows how important it is to wait and have a confirming candle within the guidelines set out in the DTFL Course!

Be sure to follow the FX+ Blog as part 2 of this article I will discuss the pullbacks in a different light that might make it just that much easier for traders to understand the reasoning behind it. I’ll also show you how to think like SM would think…

Happy Trading,

Allen